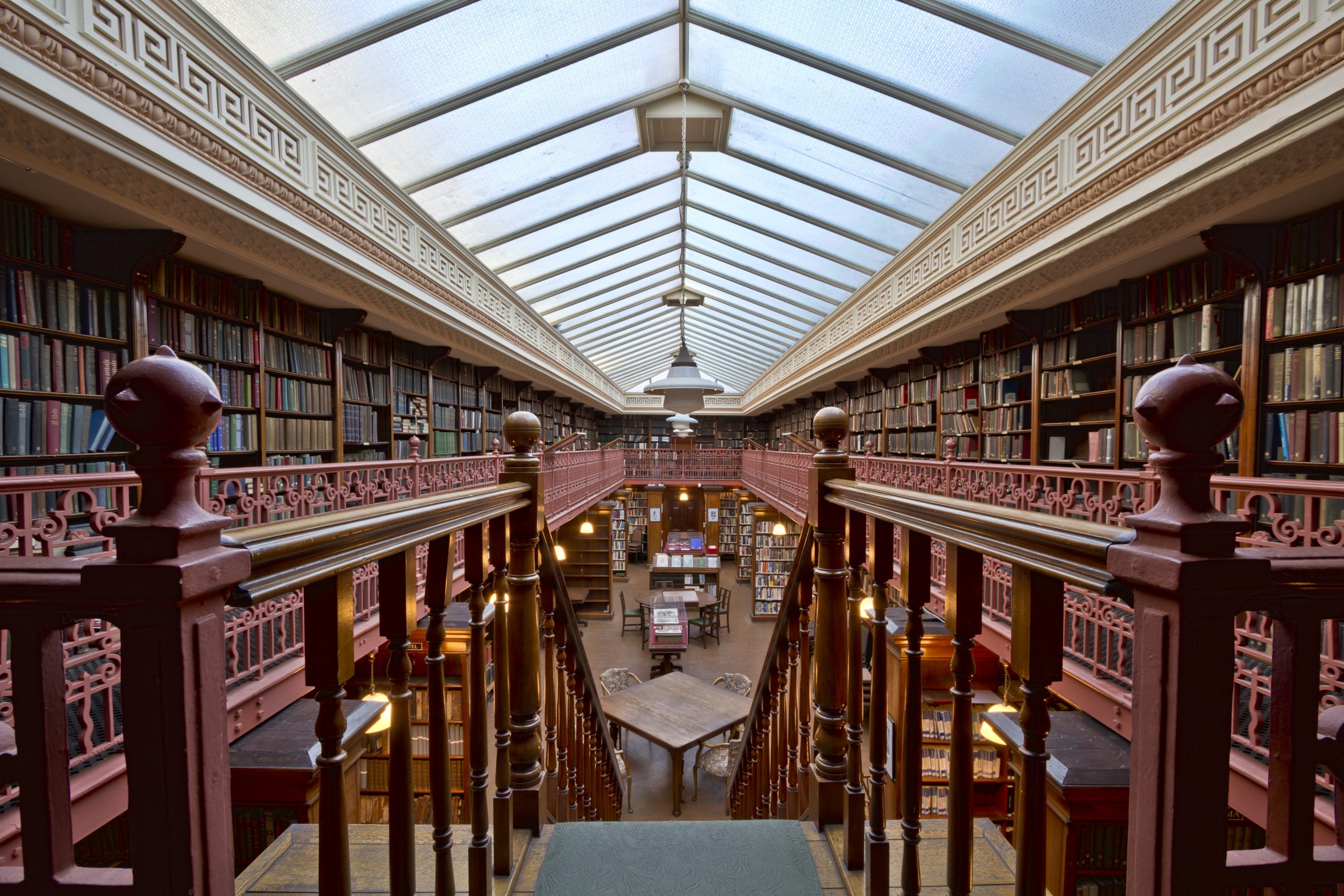

The Brotherton Library, opened 1936.

The Brotherton Library, opened 1936.

Promoting science & the arts and supporting the city of Leeds since 1819

We’ve been going over 200 years, but we’re up to date

The Leeds Philosophical and Literary Society is a charity whose purpose is ‘To promote the advancement of science, literature and the arts in the City of Leeds and elsewhere, and to hold, give or provide for meetings, lectures, classes, and entertainments of a scientific, literary or artistic nature.’

Welcome to the Leeds Philosophical and Literary Society.

Featured projects & stories

Explore more

Grants

The Society makes grants both to individuals and to organisations in support of cultural and scientific activities which increase innovation, outreach and diversity in Leeds and its immediate area. It also supports local museums and galleries and publications relating to the city.

Events

Since 1819, the Phil & Lit has been inviting the people of Leeds to hear from knowledgeable and entertaining speakers. Many are leaders in their field of science, arts or current affairs. We also hold an annual Science Fair and organise occasional visits.